- The Best Online Brokers in Canada for Beginners (2025): A Simple Guide to Start Investing

- RESP Explained: How to Save for Your Child’s Education in Canada

- Unlock Awesome Ways to Start Investing with Just $100 in Canada

- Finance 101: The Ultimate Guide to Managing Your Money

- Emergency Fund 101: How Much Should You Save?

For newcomers and residents in Canada, finding the right High-Interest Savings Account (HISA) is key to building savings safely while still earning meaningful returns. In 2025, Canadian banks are offering attractive promotional rates that far exceed traditional savings accounts.

Why Choose a HISA?

- Safety: CDIC insurance up to $100,000.

- Liquidity: Access funds anytime without penalties.

- Returns: Promotions range 3.5%–4.5%, compared to standard 0.01%–0.30%.

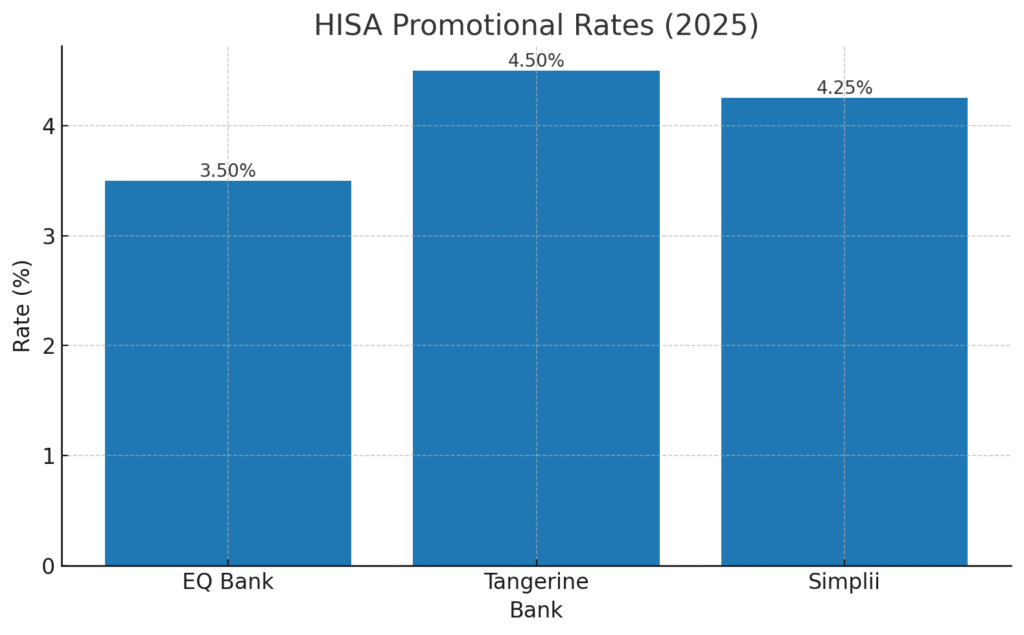

Table 1: HISA Promotional Rates Comparison

| Bank | Promo Rate | Eligibility | Duration | Limit |

|---|---|---|---|---|

| EQ Bank | 3.50% | Direct deposit $2,000+/mo | Ongoing (if condition met) | No limit |

| Tangerine Bank | 4.50% | New clients | 5 months (153 days) | $1,000,000 |

| Simplii Financial | 4.25% | New clients / within 60 days | 4 months | $100,000 |

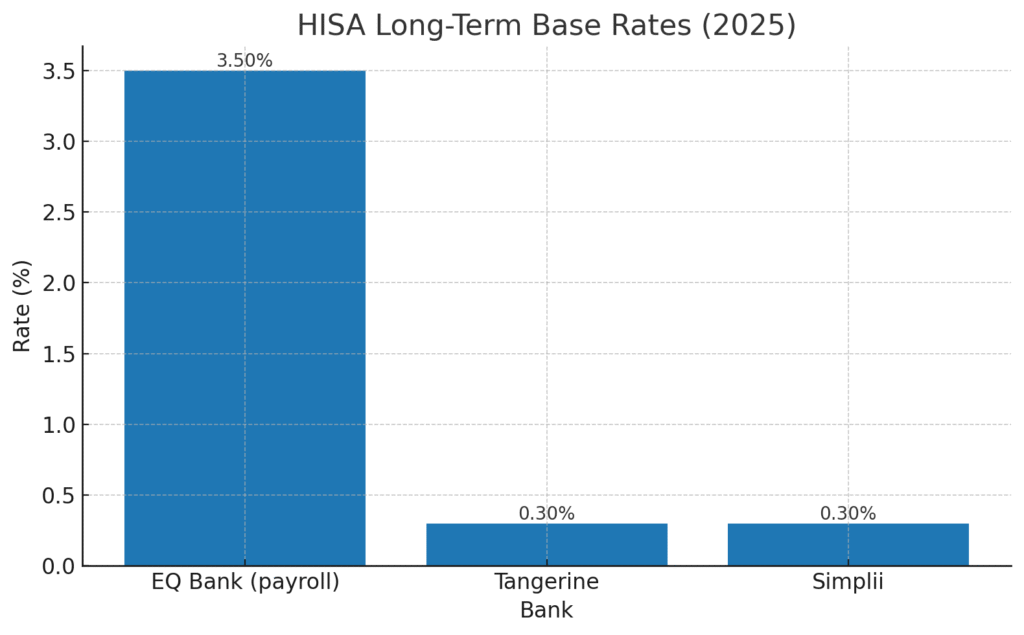

Table 2: HISA Long-Term Base Rates Comparison

| Bank | Base Rate Structure | Standard Balance (≤$50k) |

|---|---|---|

| EQ Bank | Conditional rate | 3.50% (if payroll deposit) |

| Tangerine Bank | Flat rate | 0.30% |

| Simplii Financial | Tiered rate | 0.30% |

Who Benefits Most from HISA?

- New immigrants: Saving for PR fees or first rent deposit.

- Families: Building emergency fund.

- Investors: Parking cash before entering markets.

FAQ

Q. Is the interest taxable?

Yes, unless kept in a TFSA HISA.

Q. Are promotional rates permanent?

No, most revert to 0.30–1.25% after the promo period.

Final Thoughts

For 2025, Tangerine and Simplii stand out for short-term promotions, while EQ Bank offers a strong long-term option if you set up direct deposit.